Defensibility Through Execution: Building the Next Generation of Bio Platforms

Biologists and engineers can now start companies with little more than an idea. So how do we develop a durable defensibility?

Today, biologists and engineers can start companies with little more than an idea. Rather than giving away most of the equity through venture-builds from the get-go, founders can now pursue their relentless ambitions and be rewarded accordingly. There is no longer a need for supervision from ‘people-that-have-been-there-before’. Of course, experience is essential, but this can be acquired by hiring the right people early on. This change in philosophy — founder-led, idea-driven — has brought a change in the origin of biotech companies.

Founders don’t have to adhere to any playbook when starting a company. However, due to the risky nature of drug discovery and development, biotech investors usually stick to a checklist of items to cross off before they decide to fund a start-up. Highly regarded PI involved? Check. Experienced CEO? Check. Filed patents? Check. And so on. This is understandable, given that companies are working with human health. Yet these requirements make it extremely hard for first-time founders to raise funding and pursue new ideas. In the past few years, there’s been a transformation in what these ventures need to get off the ground, leading to the current Cambrian explosion of multidisciplinary bio companies.

An increasing number of companies in the techbio space are starting without any inherent defensibility; they may not have patents, or even specialized know-how at the point of the first investment. Rather than using a specific patent family, perhaps licensed out from a university, companies are rooted in a mission to solve a specific problem with a solution designed from scratch. In order to deliver better therapies to patients or decrease carbon emissions, companies require a way to stay competitive in the short- and the long-term. These burgeoning firms have a new approach towards product development, and it is this approach itself that makes them defensible.

Defensibility and differentiation in platform bio companies

This new breed of bio companies applies engineering principles to bio-based product development.

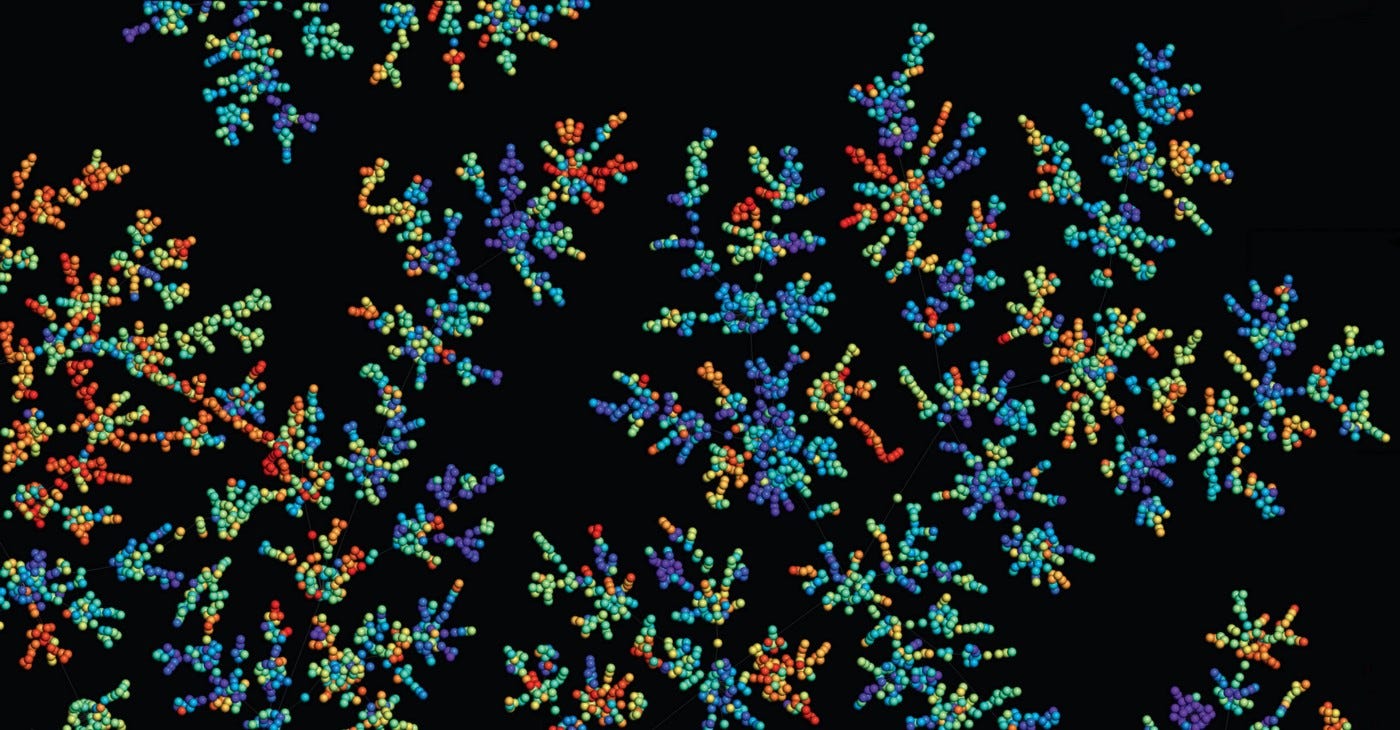

Working within a large theoretical search space, such as chemical and ‘omic sequence spaces, means that the company’s whole platform must be geared towards increasing the rate of Design-Build-Test-Learn (DBTL) cycles. These cycles identify local maxima/minima that might represent, for example, promising drug candidates or targets. This, in turn, provides the foundation of new patents.

Platform companies face both product- and platform-level competition. In therapeutic platform companies, for example, competitors could be developing a product in the form of a drug to treat the same indication or have a similar platform value proposition. The discussion around competition at the product vs platform level deserves its own post, but — briefly — at the platform level, you need a defensible and differentiated position to attract pharma partnerships, investors, and the most talented hires.

The extent of the platform’s defensibility and differentiation will influence the business model that the company chooses. As defensibility and differentiation increase, the more value the start-up can capture through partnerships, in turn increasing the company’s ratio of partnered to internal assets increases.

In addition, the more advanced the asset or product the start-up wants to partner, the greater the partnership value. For instance, a therapeutics company will be able to capture a larger proportion of its potential value when its proposed drug is more de-risked. Naturally, this also means that the extent of platform or product validation will influence the proportion of value captured by the start-up.

DTE: how the new generation of bio companies generate defensibility

At this point, it is useful to divide defensibility into two categories: Defensibility Through Execution (DTE) and Patent-Driven Defensibility (PDD).

DTE is the process by which companies build DBTL platforms to identify promising products.

This translates into a short-term competitive advantage and a long-term defensible position. DTE makes companies the go-to partners for pharma firms and a magnet for talent. On the other hand, companies with PDD have a strong patent (or know-how) position from the get-go (e.g. CRISPR-based companies with licensed IP from academic institutes). PDD and DTE are not mutually exclusive, as companies can have both levels of defensibility, for example, by building a unique DBTL platform based on patents or for patenting along the way through DTE.

How to build Defensibility Through Execution?

Ideally, robust DTE is a combination of three main features: infrastructure, know-how, and data (and its network effects).

Infrastructure: both software and hardware infrastructure that have been explicitly designed to navigate a large data space provide a layer of defensibility towards other emerging companies. This can include high-throughput hardware systems for screening, computational & machine learning pipelines, and algorithms.

Know-how: if you remove the communal knowledgebase of the company and its people, infrastructure and data aren’t worth anything more than their asset value. Know-how glues together how you can use hardware, software, and data to develop useful products.

Data (and its network effects): Data can provide barriers to entry and a point of differentiation for platform companies. The higher the proportion of data that is internally generated, the stronger the moat others must cross to compete. Data network effects in bio companies, as described here, can decrease the time to market for each product and improve the core product features. While data network effects can kickstart a company’s DTE, infrastructure and know-how are needed to provide long-term defensibility. This is because the value of data can plateau quickly, as larger data sets do not necessarily mean better models and competitors can build their own data sets.

Companies that build DTE are multidisciplinary and commonly have computational and hardware components that are inseparable from the platform. Beyond therapeutics, bioproduction companies can also build defensibility through this approach. Companies including Recursion Pharmaceuticals, Waypoint Bio, Enveda Bio, Known Medicine, Dyno Therapeutics, Ladder Therapeutics, Octant, Basecamp Research, Gordian Bio, and Climax Foods have all built DTE which has led to tangible IP in the form of patents.

For example, Enveda is a Hummingbird portfolio company founded by Viswa Colluru with the mission to harness the inherent bioactivity of plant compounds. The Enveda team has built the necessary infrastructure, know-how, and databases to run fast DBTL cycles to identify plant-derived metabolites with therapeutic potential. These components lead to the patent-protected compounds that Enveda needs to get drugs to patients, but also to generate defensibility that helps the company maintain its position as the go-to plant-derived medicine discovery company.

DTE, however, isn’t useful in all situations. It fails when:

The company’s main risk is biological or clinical. If, after building DTE, the product’s risk profile is unchanged when compared to the products arising from state-of-the-art platforms, then the approach adds little value. Likewise, if the overall risk of a drug development company arises from late-stage clinical trials, and the company’s platform does not reduce that risk, DTE is unlikely to help.

The search space is small. For instance, when trying to identify an antisense oligonucleotide sequence against a specific target. Since this is constrained by the target RNA sequence, DTE here is limited as any company can easily sample the entire search space.

With new companies, investors, and scientists supportive of the founder-led movement, the world will see rapid progress in applied biology to solve the most pertinent problems across climate and health. With the coming generation of bio companies and founders, there is also a shift in what a start-up requires at seed stage: an idea and a world-class team. To make those ideas a reality, to create better products for patients and customers, and to grow profitable businesses, we need a foundation built on defensible platforms.

Glossary

Competitive advantage: factors that a company can leverage against its competitors

Defensibility: how a company protects its market-leading position

Differentiation: the difference in value proposition with a company’s competitors

NPV (Net Present Value): the current value of all future cash flows

Partnership: a collaboration between two or more companies in which each contributes different resources

Value Capture: the proportion of NPV for a partnership to each party

Value Proposition: how value is delivered to the partner, patient, or customer

Image credit

Cellular Network: MIT News

Chemical Space: Jean-Louis Reymond

ASO: SynBioTech.com

Reach us on twitter @ Pablo Lubroth and Xinchen Wang